Take a fresh look at Sun Life for Healthcare Professionals

Choice of competitively priced Premium and new lower cost Preferred Long-Term Disability plans

Full product suite available now including Absence, PFML, Dental/Vision, & Supplemental Health

Healthcare professional-specific Underwriting, Account Management, and Claims - all in one company: Sun Life

Modern, digital experiences that make benefits easier

New! A Non-physician provider offering

Physicians, dentists, and many other healthcare professionals specialize in the care they provide. They devote significant time and energy to earn the credentials necessary to meet the healthcare needs of their communities. Presently, they are navigating a provider crisis that is leading to longer patient wait times and burnout. This means medical practices need innovative ways to attract and retain talent, including offering competitive group benefits from Sun Life that directly address the specific needs of their healthcare professional staff.

Non-physician providers represent an expanding demographic necessitating more specialized benefits

Sun Life’s Healthcare Professional offering has been expanded to offer more comprehensive LTD income protection benefits for non-physician providers (also known as healthcare extenders) who deliver specialized patient care.

Examples include:

- Registered nurses

- Physician assistants

- Licensed nurse practitioners

Income protection

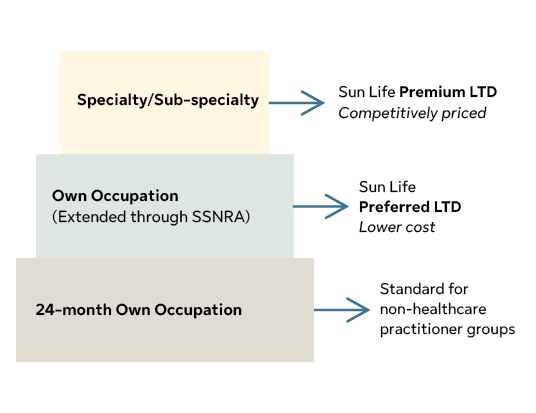

Sun Life’s competively priced Premium and new lower cost Preferred Long-Term Disability plans can be tailored to address Healthcare Professional higher income needs and income complexity.

Specialty/subspecialty definition of disability

For physicians and dentists, we use the Own specialty/sub-specialty definition of Disability where duties are defined by the actual procedures preformed.

For non-physician providers, we use the Own specialty/sub-specialty definition of Disability where duties are defined by the actual duties of the specialty/sub-specialty.

Full benefits portfolio.

- Group life insurance in amounts that meet healthcare professional needs.

- Dental, vision, and supplemental health benefits that help fill gaps for members with out-of-pocket medical expenses.

- Employee Assistance Program for access to resources to help combat stress and burnout.

- Absence management solutions to help ensure compliance with federal and state laws, including paid family and medical leave requirements.

Since 2006, Sun Life has managed claims for Healthcare Professionals, taking into account their unique incomes and needs.

Healthcare professional-specific service. Our specialized Underwriting, Account Management and Claims teams have a strong understanding of the healthcare market, and all aspects of the member and Client journey are managed by one company: Sun Life.

- Single dedicated Implementation Resource for each case

- Specalized, proactive Account Management support

- Dedicated Quoting & Underwriting team

- Expert Claims team

With modern digital experiences.

Healthcare practices come in all sizes and have different and unique needs. From file feeds to enrollment to reporting needs, we have you covered. Here are examples of our digital experiences:

- File feed integration or API connectivity

- Benefits Explorer virtual education

- Online claims functionality: submit claims, real-time claims status, view claims reporting

Dental insurance is not available to dentists.

Advertisement is not approved for use in New Mexico.

Group life and disability insurance policies are underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) in all states, except New York, under Policy Form Series 15-GP-01, 15-ADD-C-01, 16-DI-C-01, 15-LF-C-01, 12-GPPort-P-01, 12-STDPort-C-01, 13-ADDPort-C-01, 15-LFPort-C-01.

In New York, group life and disability insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 15-LF-GP-01, 15-GP-01, 15-LF-C-01, 16-DI-C-01, 15-ADD-C-01, 13-ADDPort-C-01, 12-STDPortC-01.. The disability policies provide disability income insurance only. They do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Insurance Department.

#1193168128 8/23 (exp 8/25)